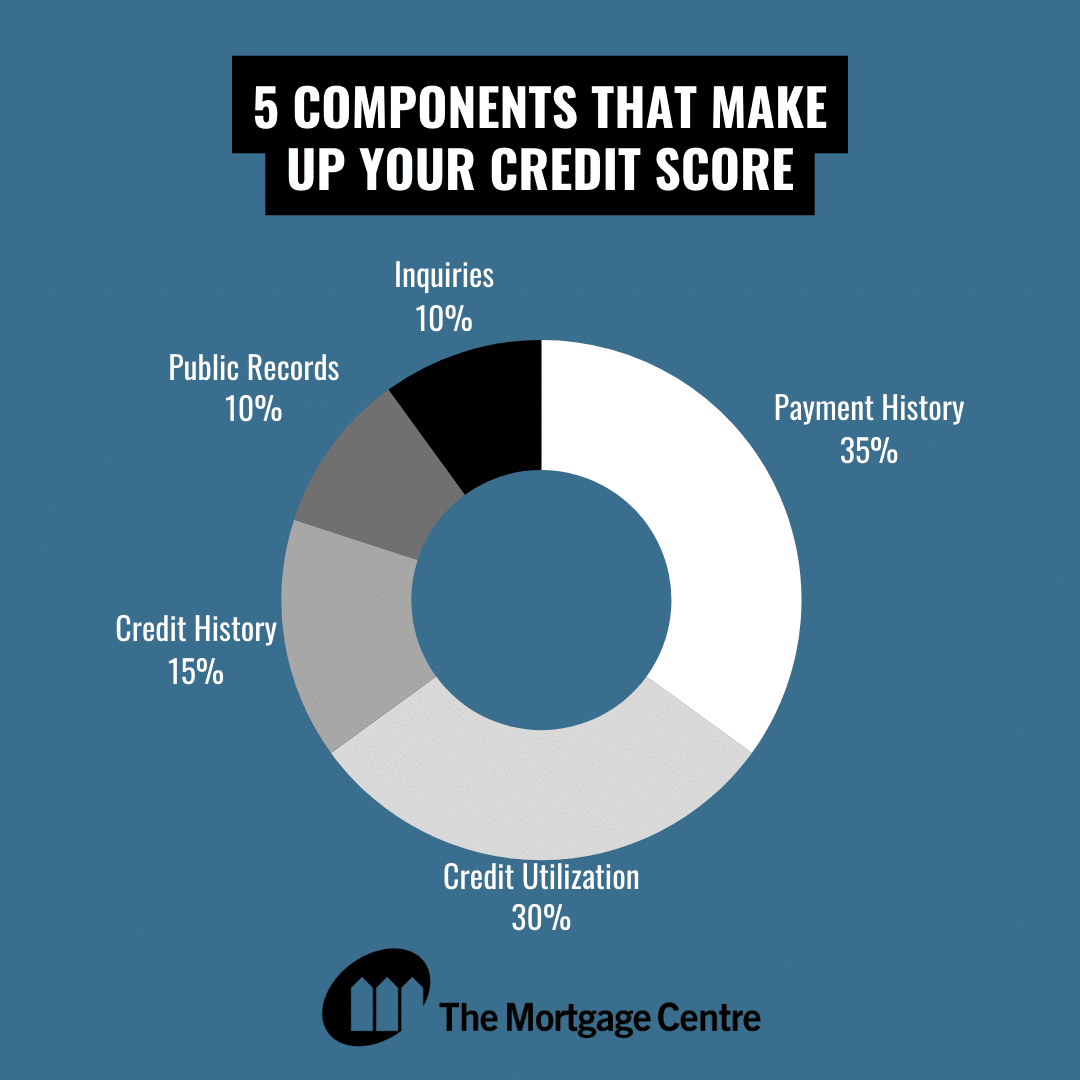

Welcome to Tristar Funding Corp. o/a The Mortgage Centre, where we empower Ontario residents on their path to homeownership by demystifying the world of credit scores. In this guide, we’ll explore Equifax’s five key components that shape your credit score and provide actionable tips to boost your creditworthiness.

1. Payment History (35%)

Your payment history is the cornerstone of your credit score, constituting 35% of the total score. It reflects your track record of making timely payments on credit accounts, including credit cards, loans, and mortgages. To maintain a positive payment history:

- Set up automatic payments or reminders to ensure you never miss a payment.

- Prioritize paying at least the minimum amount due on time for all your credit accounts.

- Communicate with creditors if you encounter financial difficulties to explore payment arrangements and avoid delinquencies.

2. Credit Utilization (30%)

Credit utilization measures the ratio of your outstanding credit balances to your total available credit, comprising 30% of your credit score. To optimize your credit utilization:

- Aim to keep your credit card balances low relative to your credit limits, ideally below 30%.

- Consider spreading out your balances across multiple credit cards rather than maxing out a single card.

- Paying down existing debt can significantly improve your credit utilization ratio and positively impact your score.

3. Credit History Length (15%)

The length of your credit history accounts for 15% of your credit score and reflects how long you’ve been using credit. While you can’t change the length of your credit history overnight, you can:

- Keep old accounts open to maintain a longer average account age.

- Avoid closing accounts with positive payment history, as they contribute to your credit history length.

- If you’re new to credit, start building a positive credit history by opening and responsibly managing credit accounts.

4. Public Records (10%)

Public records, such as bankruptcies, liens, and judgments, are considered in your credit score and make up 10% of the total score. While negative public records can have a significant impact on your score, you can mitigate their effects by:

- Addressing any public records promptly and taking steps to resolve outstanding debts.

- Maintaining a positive payment history and demonstrating responsible financial behaviour moving forward.

5. Credit Inquiries (10%)

Credit inquiries account for 10% of your credit score and reflect the number of times lenders have accessed your credit report. While certain inquiries, such as those related to mortgage or auto loan applications, are considered normal, excessive inquiries can signal financial instability. To minimize the impact of inquiries:

- Limit the number of credit applications you submit, particularly within a short timeframe.

- Be strategic about applying for credit and only pursue new accounts when necessary.

Conclusion

Understanding Equifax’s five components of credit scoring is crucial for anyone striving to improve their credit health. By focusing on maintaining a positive payment history, optimizing credit utilization, nurturing a lengthy credit history, addressing public records responsibly, and minimizing credit inquiries, you can enhance your creditworthiness and pave the way toward achieving your homeownership goals.

At Tristar Funding Corp. o/a The Mortgage Centre, we’re here to support you every step of the way on your journey to homeownership.

Contact us today to explore personalized mortgage solutions tailored to your unique financial situation and goals.

Let’s turn your homeownership dreams into reality together!

For further reading checking out Equifax’s website here.