COVID-19 INFORMATION

We sincerely hope you and your family are staying safe during these uncertain times. In order to keep our staff, clients, and everyone else in the community safe and to help stop the spread of COVID-19 our office doors are physically closed. We are still open for business as usual and are available by phone (519-743-4365), email and video conferencing will be available upon request with Chelsea and Jonathan Kitts. You can contact your broker or agent on the cell phone number or email listed below. We are here to help during this time, please feel free to reach out about absolutely anything we may be able to assist you with.

CONTACT INFORMATION

Richard Kitts – 519-743-5374 – rkitts@mortgagecentrekw.com

Paul Eckmier – 519-743-4367 – peckmier@mortgagecentrekw.com

Chelsea Kitts – 226-338-1671 – ckitts@mortgagecentrekw.com

Jonathan Kitts – 226-338-1672 – jkitts@mortgagecentrekw.com

Jennifer Lovsin – 519-829-5588 – jennifer@jlovsin.com

Katie Childs – 519-743-4366 – katiechilds@mortgagecentrekw.com

Bhavina Bhogal – 519-743-4365 ext. 0 – kitts.team@mortgagecentrekw.com

For general inquiries, please call 519-743-4365 ext. 0 or email kitts.team@mortgagecentrekw.com and we will get back to you ASAP.

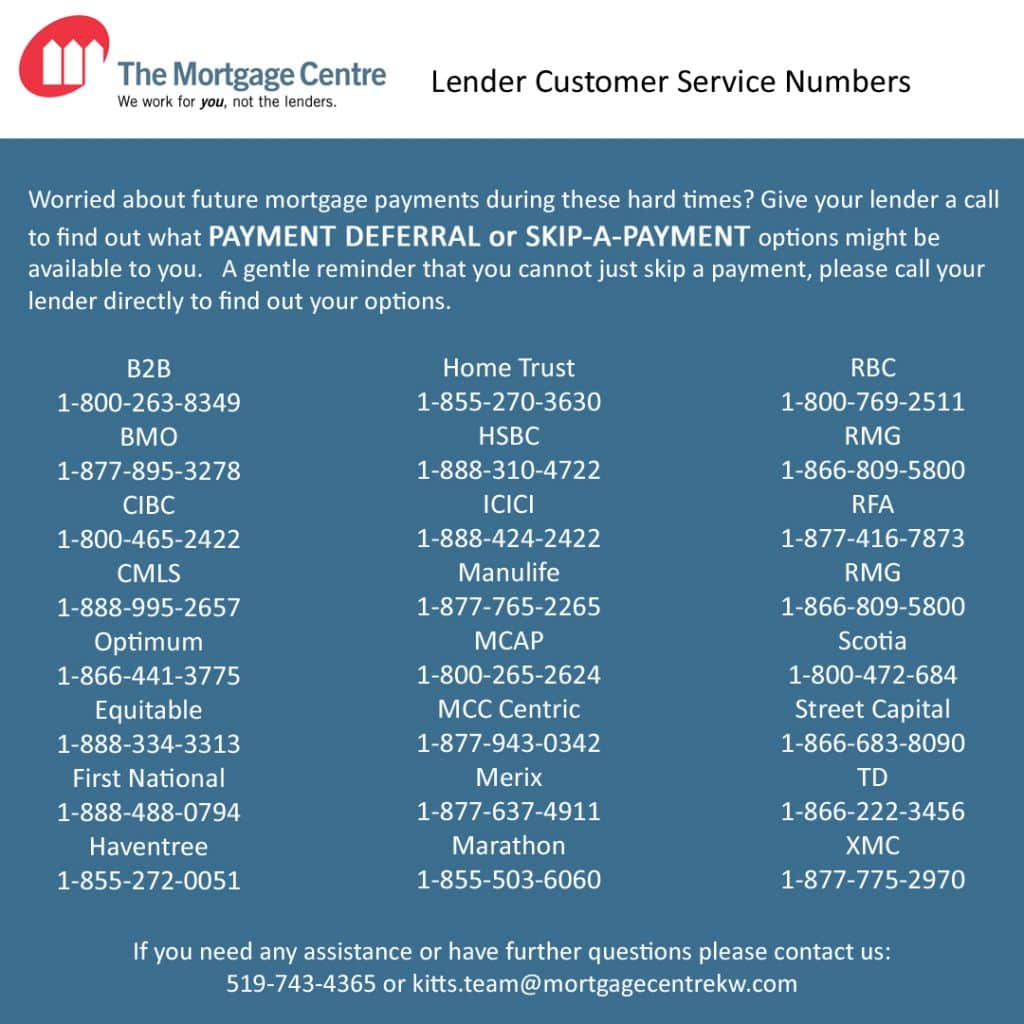

MORTGAGE PAYMENT DEFERRAL & WHAT LENDERS ARE DOING

Lenders are doing their best to provide relief for those clients who need it while they navigate these unprecedented times It’s important to note that deferred payments are only for those who absolutely need it. If you have savings and can use those, we recommend doing that instead of deferring. Please see a list below of bank and lender customer service numbers where you can call and ask about any options regarding payment deferrals that might be available to you. They will be reviewing files on a case by case basis. It is important you don’t just skip a payment during this time, make sure you talk to your lender first. If you are having trouble getting through you can always visit your lender’s website for more information on what they are doing. As always, you can contact us for any further information as well.

It is important to note that when you defer a mortgage payment, generally a lender will take the interest that would've been paid and add it to your monthly mortgage balance. When your current mortgage term comes to maturity, moving forward the payments will be calculated using the higher mortgage balance.

Lenders are offering different options to assist you which also include re-amortization of mortgage, special arrangements for payments and the capitalization of outstanding interest and costs, you must call your lender to find out what applies to you.

In addition to big banks, monoline lenders and credit unions, the mortgage insurers Genworth Canada, Canadian Mortgage and Housing Corporation (CMHC) and Canada Guaranty are also offering 6 month mortgage payment deferrals to those who purchased a home with less than 20%.

EMPLOYMENT INSURANCE (EI)

EI is available for those who have experienced a lay off, job loss or reduced hours from their insurable employment. The basic rate for calculating EI amounts are 55% of your weekly average insurable earnings. The maximum amount you can receive is $54,200 annually or $573 weekly.

You can apply for EI by clicking here.

CANADA EMERGENCY RESPONSE BENEFIT ACT (CERB)

For those who do not qualify for EI, the CERB has been implemented. If you are eligible for both, you can only choose ONE. The CERB is giving a monthly taxable amount of $2,000 to those who qualify for up to four months. The CERB is available for:

- those who do not qualify for employment insurance who are self-employed persons or contract workers

- individuals are still employed but aren’t being paid or going into work due to COVID-19

- individuals who must stop work without access to paid lead because of COVID-19

- anyone who sick, taking care of someone else who is sick, or quarantined because of COVID-19

- those working parents who have been affected by school closures and have to stay at home to care for their children without pay

You can apply for the CERB here.

CANADA CHILD BENEFIT (CCB)

There is a $300 monthly increase per child for the CCB and is going to be delivered as part of the scheduled payment in May. Those who already receive this benefit do not need to apply.

Individuals eligible for CCB are parents who take care of/ have children under 18.

If you’ve not already applied you can do so here.

SPECIAL GOODS AND SERVICES TAX CREDIT PAYMENT

For low to modest income families, there will be a one time payment credit in May through the Goods and Services Tax (GSTC). The amount on average will be around $400 for single individuals and $600 for couples. It will come automatically to those who are eligible, you do not need to apply for it.

You can find more information here.

CANADIAN EMERGENCY WAGE SUBSIDY (CEWS)

This program that is being continuously worked on by the federal government will help those businesses affected by COVID-19. There will be a temporary wage subsidy of 75% of the first $58,700 regularly earned by employees, for now the program is in place for the 12 week period from March 15th to June 6th, 2020.

Those eligible include:

- employers that suffer gross revenue drop of at least 15% in March, April or May compared to January or February of 2020.

- public sector entities excluded, employers of all sizes and across all sectors are eligible.

- additional support for charities and non-profit organizations is currently being considered by the government and will be announced in the near future.

- those who are not eligible for CEWS may still qualify for the previously announced Emergency Wage Subsidy.

Businesses can apply online though a CRA portal that will be available soon.

You can find more information here and here.

BUSINESS CREDIT AVAILABILITY PROGRAM (BCAP)

ADDITIONAL SUPPORT

CREDITS AND BENEFIT

DEFERRAL DATES

- Individuals, Self-employed, Corporations, and Trusts

- Student Loans

- Mortgage Support Payment Deferral

LOANS FOR BUSINESSES

COMPLETE LIST OF MEASURES FOR BUSINESSES

ONTARIO CHILDCARE SUBSIDY

ONTARIO PROVINCIAL LAND TAX PAYMENT DEFERRAL

Here are some links to reliable sources of information regarding COVID-19

- Being prepared and preventing the spread

- Self-isolating

- Self-monitoring

- Mortgage Centre Canada & COVID-19